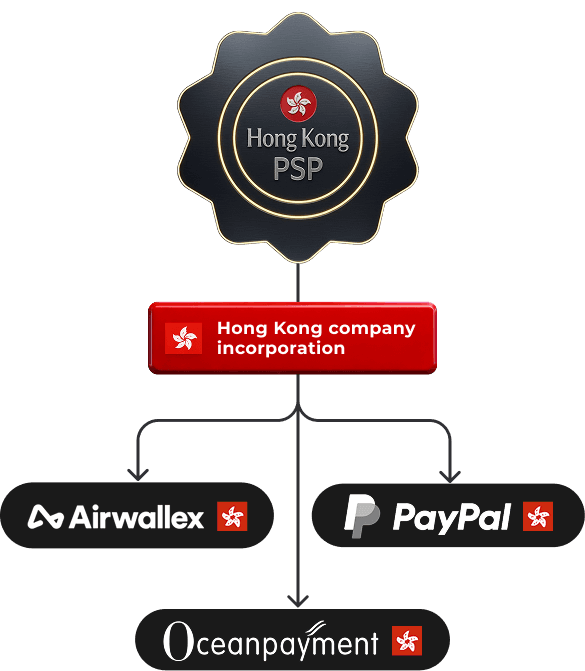

What Is a Hong Kong Payment Service Provider?

A Hong Kong Payment Service Provider (PSP) is a regulated financial platform that enables businesses to process payments without many of the restrictions found in traditional processors such as Stripe, PayPal, or 2Checkout. While typical payment platforms often freeze funds, limit usage, or unexpectedly shut down accounts, Hong Kong PSPs operate under a strong regulatory system built to support high-volume international transactions.

These PSPs are designed for companies that need unlimited processing capabilities, multi-currency functionality, and protection from the account of disruptions commonly experienced with mainstream processors. Hong Kong's regulatory environment offers the stability, reliability, and freedom businesses need to scale without interruptions.

Key PSP Features:

- • No limits on daily or monthly processing volumes

- • No unexpected account freezes or random reviews

- • Supports multiple currencies (USD, EUR, GBP, HKD, and more)

- • Handles international and cross-border payments

- • Strong regulatory oversight and protection

- • 24/7 technical support and system monitoring